Daycare Tax Credit 2019 Form

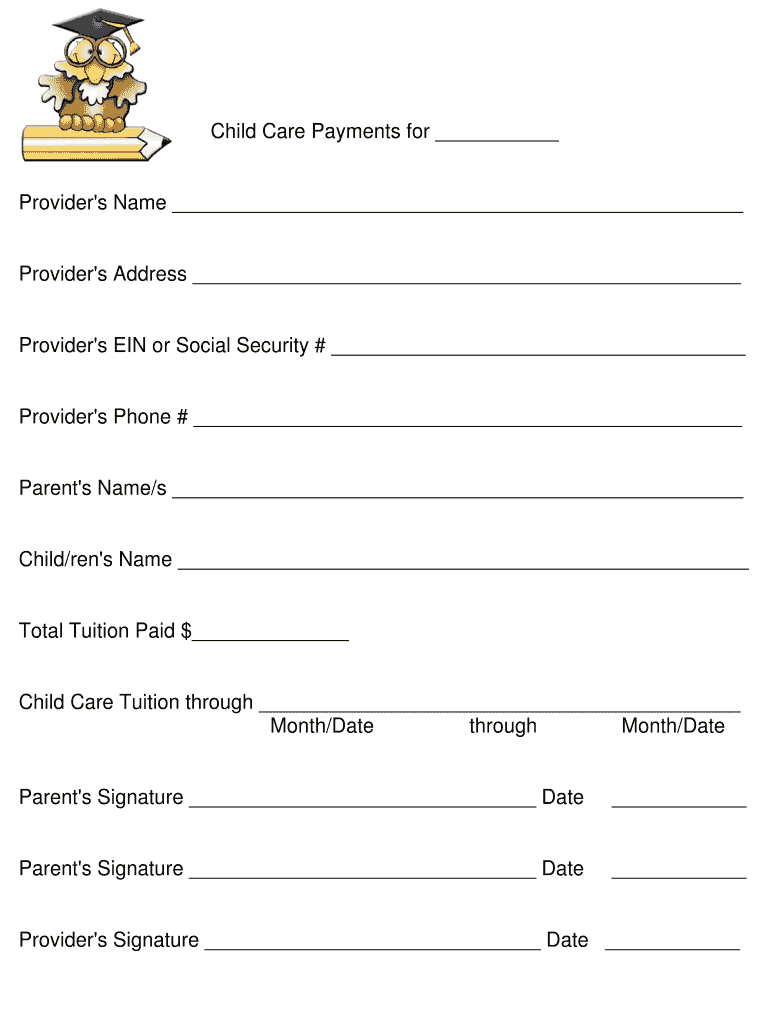

Chapter 51012-12 Child Care Centers Chapter 51012-13 Child Care Type A Homes Chapter 51012-14 Child Care Type B Home. You can use Form W-10 Dependent Care Providers Identification and Certification to request this information from the care provider.

The Truth About End Of Year Parent Receipts Tom Copeland S Taking Care Of Business

Before claiming this credit for tax year 2018 review the 2018 Schedule M1NC Federal Adjustments and determine if you must file this schedule.

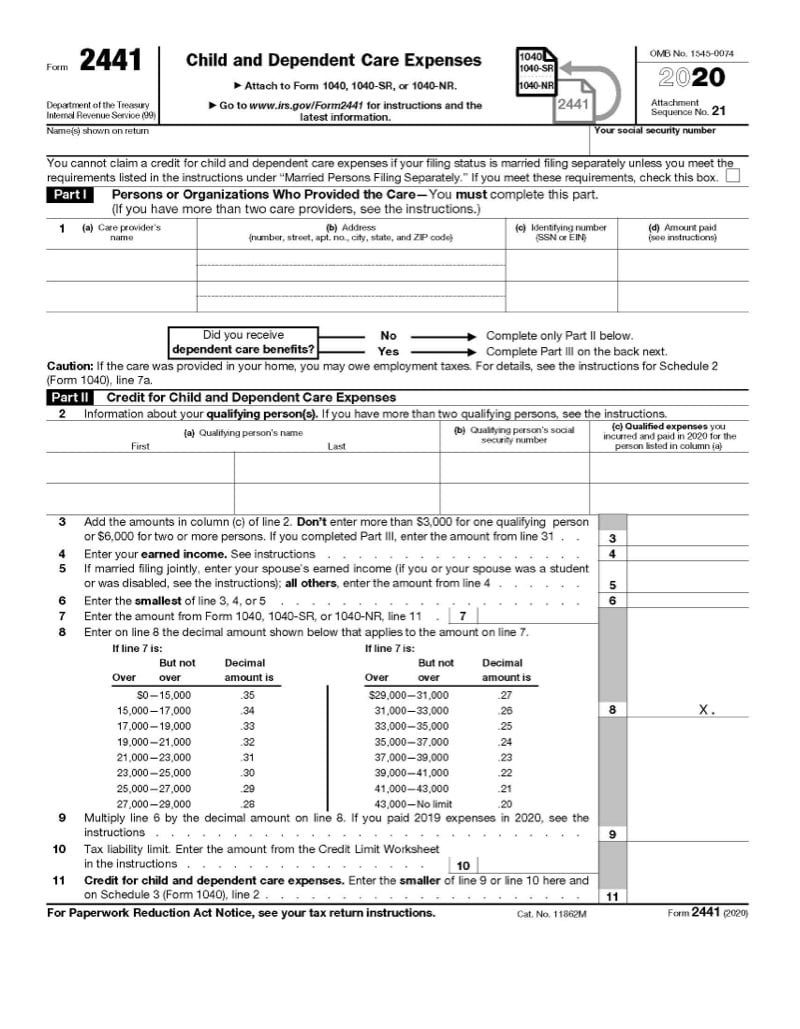

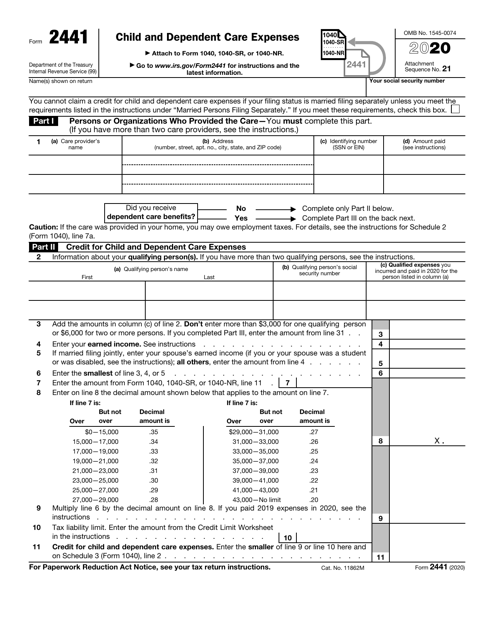

Daycare tax credit 2019 form. New Resident Registration Form. You cannot claim a credit for child and dependent care expenses if your filing status is married filing separately unless you meet the. 10 rows Child Tax Credit 2020 01132021 Publ 972 SP Child Tax Credit Spanish Version 2020.

Form 2441 and its instructions such as legislation enacted after they were published go to IRSgov Form2441. Subtract the Box 10 amount from the amount of the child and dependent care credit you can claim. 3000 for 1 person.

About Form 2441 Child and Dependent Care Expenses If you paid someone to care for your child or other qualifying person so you and your spouse if filing jointly could work or look for work you may be able to take the credit for child and dependent care expenses. To claim the credit complete Schedule M1CD Child and Dependent Care Credit. Your child can be the care provider if they are 19 years old or older.

Up to 6000 for two or more childrendependents. 2020 Dublin Individual Vouchers. File your income tax return.

If you cant provide information regarding the care provider you may still be eligible for the credit if you can show that you exercised due. If you paid a daycare center babysitter summer camp or other care provider to care for a qualifying child under age 13 or a disabled dependent of any age you may qualify for a tax credit of. We will prepare this form for you and your completed return will then include the Form 2441 Child and Dependent Care Expenses.

This applies even if youre not claiming a Child Care Credit. When you have young children one of the most difficult financial burdens is paying for dependent care but some good. Rules The emanuals websitecontains all rules forms procedure and manual letters.

2019 Days Worked Calendar. Toll Free Tax Number. If you qualify you may only claim expenses up to.

35 of all qualifying expenses up to a maximum of 3000 for one childdependent. You will receive a percentage of the amount you paid as a credit. Dublin Change of Address Form.

The amount you pay is based on your gross income and family size. Can you take a child care tax. The dependent care tax credit is different than the child tax credit and this article is intended to help you understand that basics of the credit.

Employers use this form to claim the credit for qualified childcare facility and resource and referral expenditures. If you paid for a babysitter a summer camp or any care provider for a disabled child of any age or a child under the age of 13 you can claim a tax credit of either. 2019 Dublin EZ Individual Return and Instructions.

According to IRS Form 2441 the form used for the child care tax credit the credit itself is worth between 1 to 50 percent of the qualifying expenses you claim depending on your income. If the care provider is a tax-exempt organization you need only report the name and address of the organization on your return. 6000 for 2 or more people.

Purpose of Form If you paid someone to care for your child or other qualifying person so you and your spouse if filing jointly could work or look for work in 2020 you may be able to take the credit for child and dependent care expenses. If your adjusted gross income AGI is 125000 or less you qualify for the full 50 percent. Information about Form 8882 Credit for Employer-Provided Child Care Facilities and Services including recent updates related forms and instructions on how to file.

Names shown on return. Child and Dependent Care Expenses Attach to Form 1040 1040-SR or 1040-NR. If you paid 2019.

You may be required to pay for part of your child care in the form of a copayment. Click on the chapter name to go directly to the following rules. 2018 2019 2020 care child Credit dependent Tax what.

2019 Dublin Individual Extension. Attach Child and Dependent Care Expenses Credit Form 3506. Your social security number.

When your W-2 shows dependent care benefits you must complete Form 2441 Form 1040 Part III. Up to 35 of qualifying expenses of 3000 for one child or dependent or up to 6000. City Hall 5555 Perimeter Drive Dublin Ohio 43017.

The Ohio Department of Job and Family Services ODJFS helps parent s who are working or in school pay for child care through the Publicly Funded Child Care PFCC program. 2020 Dublin Declaration of Estimated Tax for Individuals.

Reporting Child Dependent Care Expenses Irs Form 2441

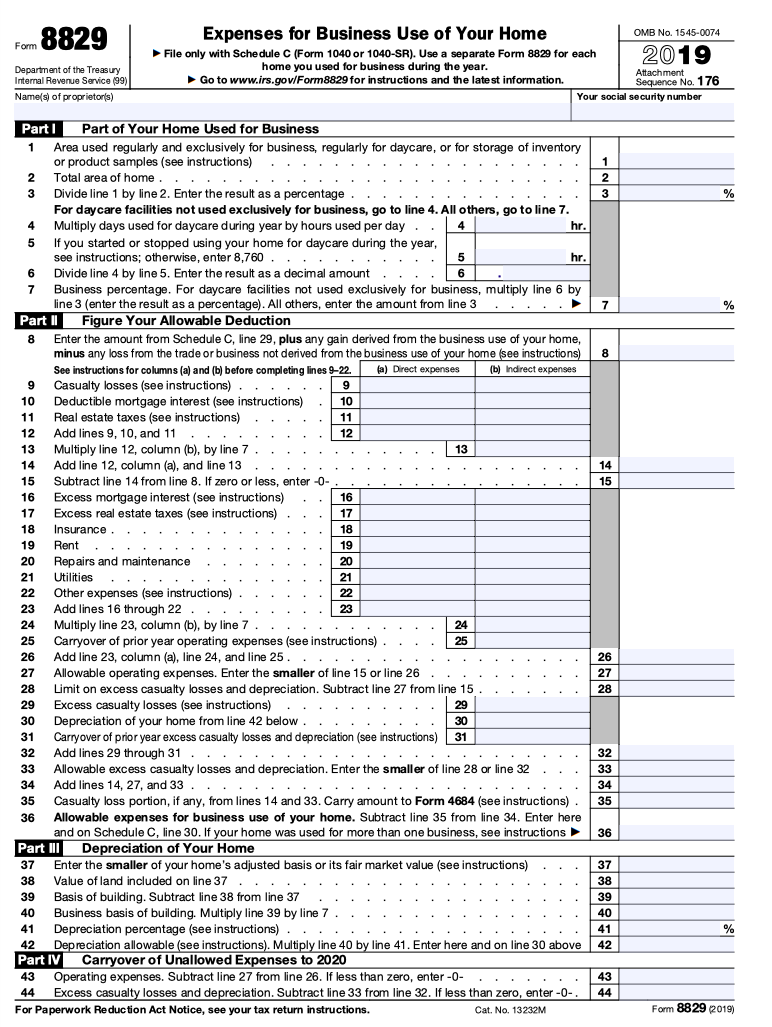

How To Fill Out Form 8829 Bench Accounting

Tax Form 2441 Instructions Info On Child Dependent Care Expenses

/2441-b1862b33c9114ea490a73925cb0252d7.jpg)

Form 2441 Child And Dependent Care Expenses Definition

The Truth About End Of The Year Parent Receipts Tom Copeland S Taking Care Of Business

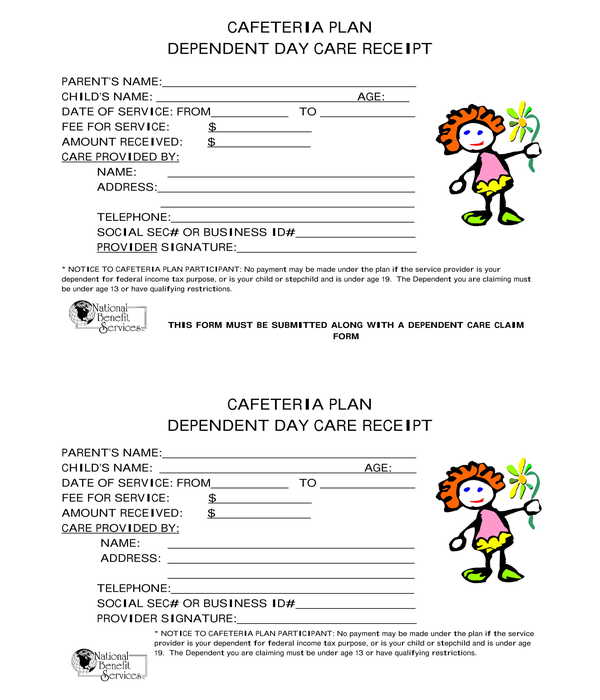

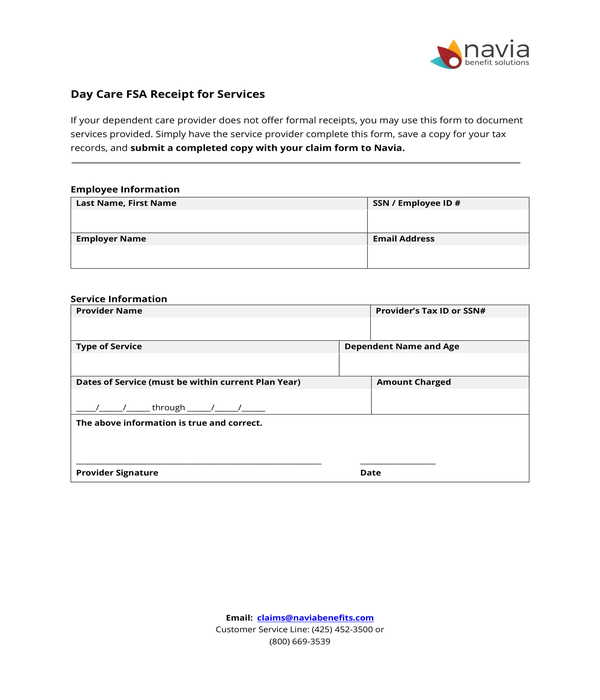

Free 5 Daycare Receipt Forms In Pdf

Time Is Almost Up To Apply For 335 Extra Credit Grant For North Carolina Families With Children Abc11 Raleigh Durham

Your Us Expat Tax Return And The Child Care Credit When Abroad

Free 5 Daycare Receipt Forms In Pdf

Can I Deduct Nanny Expenses On My Tax Return Taxhub

Irs Form 2441 Download Fillable Pdf Or Fill Online Child And Dependent Care Expenses 2020 Templateroller

Tax Form 2441 Instructions Info On Child Dependent Care Expenses

Daycare Tax Form For Parents Fill Online Printable Fillable Blank Pdffiller

Checklist For Irs Schedule C Profit Or Loss From Business 2014 Tom Copeland S Taking Care Of Business

Daycare Receipt Fill Out And Sign Printable Pdf Template Signnow

Your Us Expat Tax Return And The Child Care Credit When Abroad

Finding Child Care Ein Number 4 Ways To Do It Applications In United States Application Gov

Form 8829 Instructions Your Complete Guide To Expense Your Home Office Zipbooks